Sodexo: Strong increase in revenues and profitability in Fiscal 2022

At the Board of Directors meeting held on October 25, 2022, chaired by Sophie Bellon, the Board closed the Consolidated accounts for Fiscal 2022, ended August 31, 2022.

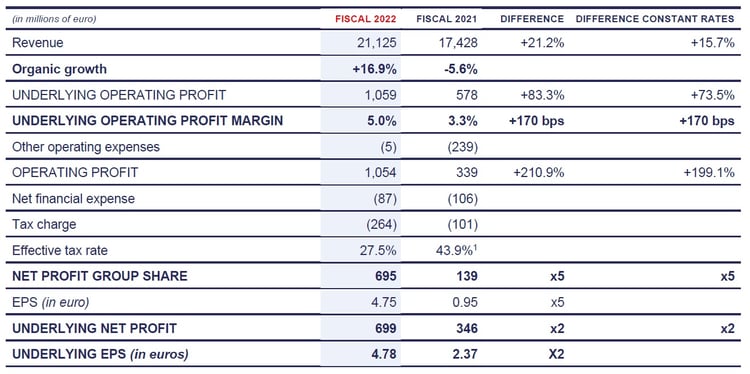

- Revenue growth +21.2%, organic growth +16.9%, Q4 returned to pre-Covid level

- Underlying operating profit margin +170 bps

- Retention at all-time high and Development improving

- Fiscal 2023 guidance:

- Organic growth: +8 to +10%

- Underlying operating profit margin close to 5.5%, at constant rates

Financial performance Fiscal 2022

"All our activities delivered a strong recovery in Fiscal 2022."

"Growth in Benefits & Rewards Services accelerated and On-site Services margins improved, despite the inflationary backdrop. Net new business was strong, and retention was at an all-time high. Our balance sheet has also been strengthened significantly.

Good progress has been made on the priorities I set out at the beginning of the year: North America generated strong growth, improved profitability and its retention and development improved significantly. We accelerated the transformation of our food models through several organic and external investments while also actively managing our portfolio of activities. The transfer of P&L responsibility to regions and countries, fully effective from October 1, 2022, will simplify the organization.

I warmly thank our teams for their impressive engagement and performance in the field with our clients and our suppliers in these challenging times.

We expect that our financial performance will return to Fiscal 2019 levels this year. I am confident that for Fiscal 2023, we can achieve +8 to +10% organic growth and a margin close to 5.5%."

Highlights of Fiscal 2022

- Fiscal 2022 consolidated revenues reached 21.1 billion euros, up +21.2% year-on-year, driven by organic growth of +16.9%, a net contribution from acquisitions and disposals of -1.2% and a strong positive currency impact of +5.5%.

- On-site Services organic revenue growth was up +17.0%. The recovery continued sequentially throughout the year, leading to a return to 99% of Fiscal 2019 level in the fourth quarter, with Business & Administrations back to over 100%.

The key elements of the year were:

- In Business & Administrations, organic growth was +22.7%. This was driven by ongoing growth in Energy & Resources and Government & Agencies, the recovery of Sports & Leisure in the second half as events and conventions picked up strongly and Corporate Services benefiting from a solid return to the office. The trend in the last two months of the year was in line with our Work from Home estimates made in 2020 and we anticipate further improvement.

- In Healthcare & Seniors, organic growth was +4.0%. Our performance was driven by pricing, cross-selling and the progressive recovery of hospital retail sales and Seniors’ occupancy. This was partially offset by the early closure of the Testing centers in the UK at the end of March.

- In Education, organic growth was +22.0%, following the strong post-Covid recovery in activity in Universities and Schools in North America, China and India.

- Significant improvement in key performance indicators:

- Client retention rate was 94.5%, +140 bps higher than the previous year. This record performance was the result of an improvement in almost all regions, especially in North America. In France, difficult inflation negotiations, particularly in public sector Schools, led to some contract exits.

- New sales development was up +150 bps at 7.5%, with a solid contribution from all segments. Total development, including cross-selling, was 1.5 billion euros. The year ended strongly with the win of the Ardent healthcare services contract to supply patient and staff dining, nutrition counselling, retail and environmental services (incl. Protecta®) to 50 locations across six States, employing 1,500 Sodexo employees.

- As a result, the net new business signed during the year was positive for the first time in several years.

- Benefits & Rewards Services delivered organic growth of +14.2%. Employee benefits organic growth was +18.7% and accelerated sequentially through the year, reaching +23.1% in the fourth quarter. Issue volume increased +16.2%, boosted by strong net new business leveraging digital products and enhanced sales efficiency, as well as face value increases. Financial revenues were also up strongly supported by rising interest rates, particularly in Latin America and Eastern Europe.

- Underlying operating profit was 1,059 million euros, up +83.3%.

- Underlying operating margin was 5.0%, up +170 bps. This significant improvement was a result of the strong recovery in volumes, the benefit of the GET efficiency program, and effective actions to mitigate inflation through indexation, contract renegotiations and productivity. The improvement was across both On-Site, up +160 bps to 4.6%, and Benefits & Rewards up +370 bps to 28.6%.

- Other operating expenses (net) amounted to 5 million euros in Fiscal 2022, compared to 239 million euros in the previous year. Restructuring costs fell to 10 million euros and gains on the sale of assets more than off-set losses.

- The Effective tax rate returned to a more normal level of 27.5% compared to 43.9% in the previous year.

- Net income Group share multiplied by five to reach 695 million euros, versus 139 million euros in Fiscal 2021. EPS was 4.75 euros versus 0.95 euro in Fiscal 2021.

- Underlying net profit doubled to 699 million euros, compared to 346 million euros in Fiscal 2021. Underlying EPS was 4.78 euros, double the previous year.

- The Board of Directors has proposed a dividend of 2.40€, up +20% compared to Fiscal 2021, in line with our policy of a pay-out ratio of 50% of Underlying net profit.

- Free cash flow was strong at 631 million euros compared to 483 million euros in Fiscal 2021, despite some non-recurring elements including the unwinding of government payment delays, significant restructuring costs, reimbursement of Tokyo Olympics hospitality packages and an exceptional contribution to the United Kingdom pension funds. Cash conversion was 91%, below the normal level of 100%, but including 363 million euros of negative non-recurring elements.

- Net debt reduced to 1.3 billion euros from 1.5 billion euros at end Fiscal 2021. Gearing2 fell to 28.7% and the net debt ratio fell to 1.0x compared to 1.7x at the end of Fiscal 2021. Our debt ratios have now returned to the bottom end of our target range.

- In Fiscal 2022, further progress has been made towards our 2025 CSR objectives. In particular,

- The business value benefiting SMEs rose +13% to 7.8 billion euros; we are well on track to reach the 10 billion euros target for 2025.

- Food waste reduction was -41.5% lower. While the reduction is lower than in Fiscal 2021, this indicator is now managed and measured across 1,873 sites compared to 878 last year. The Group remains on track to reduce food waste by 50% on 85% of our sites by 2025.

- As a people company, Lost time incident rate (LTIR) is an important indicator which we monitor closely. In Fiscal 2022, the LTIR reached 0.65, down by -8.5% year-on-year.

- Progress on our Strategic priorities:

- Boost US growth: We delivered a strong improvement in operational execution and sales development in North America

- Improved retention to over 96%, up +400 basis points, our best performance in 10 years

- Improved development by +400 basis points

- Strong Cross-selling

- Increased first-time outsourcing contracts: 44% of signatures in Fiscal 2022

- Accelerate the food model transformation:

- Deployed more new food model brands and offers with targeted investments

- Developed new client relationships with high-end brands

- Acquired companies to develop convenience offer, such as Frontline Food services and VendEdge.

- Transformed production & logistics with off-site production units.

- Advanced Food Models represented 6% of Global Corporate Services food revenues in 2022.

- Deployed more new food model brands and offers with targeted investments

- Manage our portfolio more actively:

- Completed several strategic acquisitions and investments in key activities:

- in North America and China to accelerate Advanced Food Model capabilities;

- In GPOs, to strengthen Entegra Europe;

- In Asia-pacific, Technical equipment management services to develop the range of services.

- Continued the disposal of non-core activities and geographies which reduced the Group’s presence from 56 countries to 53.

- Completed several strategic acquisitions and investments in key activities:

- Enhance the effectiveness of our organization:

- In On-Site Services, the process to transfer end-to-end P&L management to the regions and the countries regrouped into three geographic zones (North America, Europe and the Rest of the World) was fully effective from October 1, 2022.

- In Benefits & Rewards Services, a dedicated governance process has been put in place to closely monitor the implementation of the new strategic plan and provide guidance. For the first time, Benefits & Rewards Services now has its own published objectives.

- Boost US growth: We delivered a strong improvement in operational execution and sales development in North America

- Changes in the Board of Directors

- The renewal of Véronique Laury, Luc Messier and Cécile Tandeau de Marsac, as independent directors, will be proposed at the next Shareholders Meeting.

- Sophie Stabile’s mandate will not be renewed at the next Shareholders Meeting. The Board warmly thanks Sophie Stabile for her extensive contribution to the Board’s discussions over the past four years, in particular for her active participation as Chairwoman of the Audit Committee and member of the Compensation Committee.

- Jean-Baptiste Chasseloup de Chatillon, independent director who joined the Board and the Audit Committee in 2021, will become Chairman of the Audit Committee. Luc Messier will also join the Audit committee which will ensure that independent members comprise 75% of its membership.

- Federico J. González Tejera, independent director, will join the Compensation Committee. As a result, the Committee will remain 100% independent.

- Patrice de Talhouët will be proposed as a new member of the Board. Patrice de Talhouët joined Bellon SA as Managing Director earlier this year. He has more than 20 years of international experience and has had senior finance roles at significant family-controlled businesses such as Mars, Coty and JAB. Recently he was Group Chief Financial Officer of Coty, the cosmetics group quoted in New York and subsequently, European Director for JAB’s consumer fund, Coty’s holding company.

- Should all the resolutions concerning the appointment and reelection of Board members be approved at the Shareholders Meeting, the Board will be made up of six women and six men and 60% of its elected members will be independent.

Outlook

For the Group, given that On-Site activity in the fourth quarter was in line with pre-pandemic levels, we expect revenues and margins for Fiscal 2023 to return to Fiscal 2019 levels.

As a result,

- Fiscal 2023 organic revenue growth expected to be between +8 and +10% driven by:

- Further recovery in Corporate Services and Sports & Leisure;

- Positive net new business momentum including expected further improvement in retention;

- Inflationary pricing at 4-5%;

- Partially offset by the impact of the end of the Testing centers contract in the UK (-100 bps).

- Fiscal 2023 Underlying operating profit margin close to 5.5%, at constant rates, supported by:

- Continued price increases and inflation mitigation action plans.

- Operational excellence including supply chain efficiencies;

- Further ramp-up in volume;

- Increased investment to sustain growth.

For the first time, we are providing specific guidance for Benefits & Rewards Services:

- Organic growth of +12 to +15% for Fiscal 2023, driven by:

- Further progress in new business, cross-selling and retention;

- Strong demand in all regions;

- Benefits from inflation and higher interest rates.

- Underlying operating profit margin around 30% at constant rates for Fiscal 2023, supported by:

- The benefits of the topline growth flow-through;

- Increased investment in technology, digital offers, brand and sales & marketing.

To read the full version of the press release, please download the PDF:

- Press release (PDF)

- Presentation (PDF)

Conference call

- Watch the Webcast Live on October 26th, 2022 - 8:00 am (London Time) / 9:00 am (Paris Time)

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its Fiscal 2022 results.

- If you are calling from the UK / international, please dial +44 (0) 121 281 8004

- If you are calling from France, please dial +33 (0) 1 70 91 87 04

- If you are calling from the USA, please dial +1 718 705 8796

- followed by the passcode 90 44 11.

The press release, presentation and webcast will be available on the Group website www.sodexo.com in both the "Latest News" section and the "Finance - Financial Results" section.