Fiscal 2020 Results: Sodexo effectively manages through an unprecedented crisis, confident in its business model for the future

At the Board of Directors meeting held on October 28, 2020 and chaired by Sophie Bellon, the Board closed the Consolidated and Company accounts for the fiscal year ended August 31, 2020.

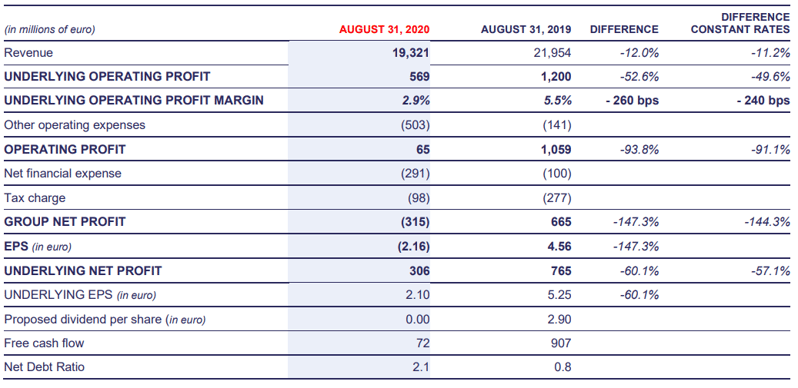

- Fiscal 2020 Revenue organic growth of -12%, of which +3.2% in H1 and -27.5% in H2

- Better than expected Q4 organic growth at -24.9% relative to hypotheses of -27%

- H2 Underlying Operating profit flow-through of 21.2%, at constant rates, within expected range

- Strong H2 positive Free cashflow despite the crisis

Financial performance for Fiscal 2020

"Fiscal 2020 was a tale of two halves. Up to the end of February, we were on track with our Focus on Growth strategic agenda in terms of growth and productivity with enhanced execution on large contracts and increased signing discipline. We were on track to meet our guidance of +4% organic growth in revenues. The Covid-19 crisis interrupted this positive momentum."

"I am proud of the way the teams reacted, fast and efficiently, to protect our people and consumers, and secure our cash in what has become the most severe downturn the Group has ever experienced. Clients have said that they valued very highly the support that we have given them to operate, reopen or ramp-up their sites in a safe and welcoming environment. Rise with Sodexo, combining all our services in an agile way, backed up by our Medical Advisory Council and Bureau Veritas certification of our protocols, is creating the necessary confidence of our people, our clients and our consumers.

We are confident that the resilience of our broad portfolio of services, the investments in marketing and digital, and responsible sourcing, our strong sense of responsibility to our stakeholders and our strong cash positive business model, will ensure that we come out of this crisis in better shape, despite ongoing market disruption."

Highlights

- Fiscal 2020 Organic revenue decline was -12%, with On-site Services at -12.1% and Benefits & Rewards Services at -7.8%. While the first half organic growth was +3.2%, the second half was down -27.5%, impacted by the Covid-19 pandemic. Details of the full year organic growth figures by activity and by geography are available in the management report.

- Second half Fiscal 2020 organic revenue growth was in line with the hypotheses published by the Group.

- The organic trend did improve in the fourth quarter, at -24.9%, relative to the -36%, adjusted for the first two weeks of the third quarter before lockdown.

- Second half On-site Services organic revenue growth was -27.8%:

- By segment, Healthcare & Seniors was relatively protected, down only -11.1%, while Education and Business & Administrations were down -47.2% and -29.2% respectively. Within Business & Administrations, Government & Agencies and Energy & Resources combined were up +1.3% while Sports & Leisure and Corporate Services were down -88% and -26% respectively.

- By geography, while there were significant declines in North America and Europe at -35.9% and -28.4% respectively, the performance in the Asia-Pacific, Latin America, Middle East and Africa region was much more resilient at -5.2%.

- All key indicators were impacted:

- Client retention rate at the end of the year was solid at 93.5%, up +20 bps, or up +110bps, excluding voluntary exits with, in particular, a +230 bps improvement in North America. Gross profit retention was higher at 95.7%.

- New sales development was down -140 bps at 4.9%, as new projects were delayed, but margin discipline was maintained with a 50 bps improvement in signed contracts.

- Same site sales decline was -11.9% reflecting the significant volume falls in many segments, particularly in Sports & Leisure, Education and Corporate Services, while Healthcare & Seniors, Government & Agencies and Energy & Resources remained much more resilient. Only the Energy & Resources segment and the Asia-Pacific region achieved same site sales growth in the second half.

- Second half Benefits & Rewards Services organic revenue growth was -18.8%, with an improving trend in Q4 at -15.1% relative to the -22.8% posted in Q3. This reflected a catch-up in activity following the end of lockdown in Europe, as restaurants re-opened and, to a lesser extent, the distribution of paper vouchers resumed. However, the trend deteriorated in Latin America as the pandemic spread across the region, particularly in Brazil, with competitive pressures increasing and interest rates continuing to fall.

- The underlying operating profit margin for the year was 2.9%. While the 1st half underlying operating margin was stable year on year at 5.9%, the 2nd half underlying operating profit margin fell to -1.5%, reflecting a flow-through of the revenue reduction of 20.4%. Excluding the currency impact, the flow-through was 21.2%, close to the most optimistic hypothesis published in July, and the second half margin was -0.9%.

- Other operating income and expenses amounted to -503 million euro, compared to -141 million euro in the previous year. Restructuring costs increased significantly to 191 million euro in Fiscal 2020 from 46 million euro in Fiscal 2019. This exceptional amount reflects proactive measures to protect margins as government support schemes come to an end, to anticipate the structural reduction in the post-Covid revenues and to be more agile as volumes ramp back up again. Impairment of certain brands and assets impacted by the substantial decline in volumes, mostly in Sports & Leisure and Education, was 249 million euro.

- Net financial expenses for the year rose to 291 million euro from 100 million euro last year, due principally to the 150 million euro make-whole payment for the USPP reimbursement and the IFRS 16 adjustments of 25 million euro. As a result of this reimbursement, the Group’s blended cost of debt at year end is 1.6% against 2.6% in August 2019.

- The tax charge amounted to 98 million euro compared to a pre-tax loss of 230 million euro. The Group has not recognized deferred tax assets for Fiscal 2020 of 122 million euro, mainly related to tax losses in France where the Group restricted the recognition of deferred tax assets to the amount of the deferred tax liabilities. Excluding exceptional elements, the underlying effective tax rate would have been 30.8% against 29.0% in the previous year.

- Reported net loss was 315 million euro, against a net profit of 665 million euro in the previous year. Basic EPS was -2.16€ compared to 4.56€ last year.

- Corrected for Other operating income and expenses including the higher restructuring costs and impairment, the make-whole on the USPP reimbursement in financial expenses and the exceptional non-recognition of tax losses, Underlying Net profit totaled 306 million euro down -60.1% compared to 765 million euro in the previous year. Underlying EPS was 2.10€, down from 5.25€.

- To protect the balance sheet given the severity of the Covid-19 downturn in activity, and the uncertainty as to the timing of recovery, and in solidarity with the teams, the Board has decided not to propose a dividend for Fiscal 2020 even if the Underlying net profit was positive.

- Free cash flow for the year reached 72 million euro, with positive cash inflow of 315 million euro in the second half, or 465 million euro excluding the make-whole payment, compensating the traditional first half outflow. This performance is the result of proactive cash management and Government support programs, partially offsetting the impact of the make-whole payment. In order to protect our cash positions, capex projects were either cut or pushed back, thereby reducing second half capex by 53% compared to the first half. As a result, annual capex amounted to 393 million euro, or 2% of revenues, against 415 million euro, or 1.9% of revenues, in Fiscal 2019.

- Consolidated net debt at the end of Fiscal 2020 was 1,868 million euro, down 206 million euro compared to the level at the end of the first half, but up 655 million euro compared to August 31, 2019. Given the decline in EBITDA, the Group’s net debt ratio was 2.1x, against 1.3x at the end of the first half Fiscal 2020 and 0.8x at the end of Fiscal 2019.

- In line with its roadmap Better Tomorrow 2025, Sodexo works to strengthen its commitment and performance to corporate responsibility. Sodexo is thus the first global foodservices company to connect its financing to action to prevent food waste. With a renewed partnership with WWF, Sodexo continues to work toward its sector-leading 34% Sciences-based carbon emissions reduction target by 2025 (compared to a 2017 baseline) by committing to eliminate deforestation from its supply chain by 2030. Sodexo continues to be recognized within the financial community, with the highest marks in SAM’s “Sustainability Yearbook” for the 13th consecutive year, as well as gold class recognition by EcoVadis. Sodexo also remains the leading company in its sector within the Dow Jones Sustainability Index (DJSI), for the 15th consecutive year and was included in the 2020 Bloomberg Gender-Equality Index, recognizing commitment to advancing women in the workplace. Sodexo also join Euronext® Eurozone ESG Large 80 Index family, recognizing its ability to reduce its emissions and to adapt the business model to address the risks and opportunities tied to the transition to a low carbon economy.

- Changes to the Board of Directors:

- Soumitra Dutta, whose term of office expires at the close of the January 12, 2021 Annual Shareholders Meeting, has stated that he does not wish to stand for reappointment. Independent director of Sodexo's Board of Directors since January 19, 2015, Soumitra Dutta has made a significant contribution to the discussions of the Board and the Audit Committee, notably in the fields of technology, digital and strategy.

- Consequently, the Board proposes to the Shareholders Meeting the nomination of Federico González Tejera as independent board member for a three-year term. Federico González Tejera, of Spanish nationality, is President and Chief Executive Officer of Radisson Hospitality AB. He will bring to the Board his strategic vision as well as his solid expertise in consumer culture gained notably in the hotel sector, where he held executive positions in several multinationals.

- During the January 12, 2021 Annual Shareholders Meeting, shareholders will also be asked to renew the mandates of Sophie Bellon, Nathalie Bellon-Szabo and Françoise Brougher:

- Sophie Bellon has been a non-independent director of Sodexo’s Board of Directors since July 26, 1989 and Chairwoman of the Board of Directors since January 26, 2016. She brings to the Board and the Group her in-depth knowledge of Sodexo. As Sodexo’s most prominent ambassador, she promotes the Company, its Quality of Life services and its mission. Sophie Bellon is committed to ensuring good governance for the Group, and is fully dedicated to the work of the Board of Directors, with an attendance rate at Board meetings of 100% for over ten years.

- Nathalie Bellon-Szabo has been a non-independent director of Sodexo’s Board of Directors since July 26, 1989, a member of the Group Executive Committee and Chief Executive Officer Sports & Leisure Worldwide since June 19, 2018. She brings to the Board her in-depth knowledge of Sodexo and its operations as well as her experience in and contribution to Quality of Life services. During her current term of office her attendance rate at Board meetings has been 97% on average.

- Françoise Brougher has been an independent director of Sodexo’s Board of Directors since January 23, 2012. She brings to the Board her international experience – particularly in the United States – as well her strategic vision and expertise as an executive of publicly traded U.S.-headquartered companies in the digital space. Her expertise is important to help Sodexo adapt to the new behaviors of consumers, customers, employees and suppliers. During her current term of office her attendance rate has been 94% on average.

- Véronique Laury will be appointed to the Audit Committee to replace Soumitra Dutta.

- Cathy Martin was renewed for a three-year term as Director representing employees starting on January 12, 2021.

"All the members of the Board sincerely thank Soumitra Dutta for his individual input to the work of the Board and the Audit committee."

Outlook

In the next few quarters, given the high level of uncertainty which we are currently experiencing the effects of the Covid-19 pandemic will continue to be significant for the Group.

The Government & Agencies and Energy & Resources segments will continue to be resilient. Healthcare & Seniors are progressively returning to pre-Covid level. Clearly, some segments, such as Sports & Leisure will not recover until the pandemic is over. Others, such as Corporate Services and Education will see activity improving progressively.

Benefits & Rewards employee benefits issue volumes will return progressively to growth as digitalization and penetration continue to progress, strengthened by working from home trends. This progression could be impacted somewhat by the rising level of unemployment. On the revenue side, the progression is linked to reimbursement patterns and impacted negatively by extremely low interest rates.

At this stage, we see an improvement in first half Fiscal 2021 relative to the second half Fiscal 2020, with an organic decline between -20% and -25%.

- The slow ramp up in S&L we experienced from July to September, mostly in France, is slowing down;

- Education is trending well in Europe but remains volatile in the US with activities varying a lot from one week to another;

- Corporate Services was on a very encouraging trend from July to September in Europe but there are signs that it will be more difficult in the next few months. North America remains very impacted in food services with very slow improvement;

- Energy & Resources, Government & Agencies, Healthcare & Seniors are progressively stabilizing and bring us resilience.

Until activity levels return to more normal levels, the Group is still using all available furlough programs. Strong restructuring measures have and continue to be taken to protect margins going forward, as government support falls away. Detailed work is being conducted across the board in all segments and activities to reduce SG&A.

Our hypothesis for the first half Fiscal 2021 Group underlying operating margin is between 2 and 2.5%.

The free cash flow for the first half Fiscal 2021 will be impacted by the expensing of restructuring costs, cash outflows linked to some payment delays obtained in second half Fiscal 2020 and the reimbursement of the 2020 Olympic Games hospitality packages. We estimate the sum of those three factors to weigh for -250 million euro on our free cash flow. On top of this, the recurrent free cash flow is usually weaker in the first half than the second and we are working with a recurrent free cash flow hypothesis of about -100 million euro for first half Fiscal 2021.

Looking further out, on the basis that the pandemic will be over by 2021 calendar year end, the Group aims to return to sustained growth and to rapidly increase the underlying operating margin back over the pre-Covid level.

The Board and the Executive Committee extend their sincere thanks to the 420,000 employees for their dedication to serving their consumers in a very difficult period for all.

Please note that Sodexo is organizing a virtual Investor Day on November 2, 2020. In a period where visibility is particularly reduced, the meeting will provide insight into how the Group adapted to the crisis and some of the most significant trends coming out of the pandemic. During this event, we will highlight and reaffirm the resilience and pertinence of our business model today and in the future, the progress we have made in the last two years and how, in a much more complex operating environment, the Group is well positioned to leverage future opportunities.

To read the full version of the press release, please download the PDF:

- Press release (PDF)

- Presentation (PDF)

Conference call

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its results for Fiscal 2020. Please find below the numbers to connect

- from the UK may dial +44 2071 928 338,

- from France + 33 1 70 70 07 81,

- from the USA +1 877-870-9135,

- followed by the passcode 63 29 034.

The press release, presentation and webcast will be available on the Group website www.sodexo.com in both the "Latest News" section and the "Finance - Financial Results" section.