Robust Sodexo First Half Fiscal 2020 Results

At the Board of Directors meeting held on April 8, 2020 and chaired by Sophie Bellon, the Board closed the Consolidated accounts for the First Half Fiscal 2020 ended February 29, 2020.

- Organic growth at +3.2%

- Q2 organic growth better than expected

- Flat Underlying operating profit margin, in line with expectations

- Mild H1 COVID-19 impact absorbed

- COVID-19 volume decline will significantly impact H2 results

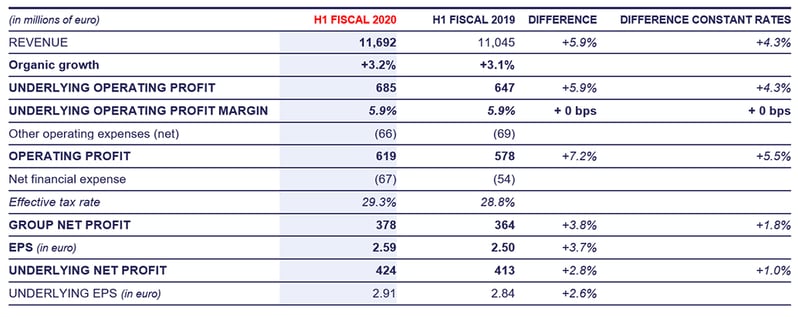

Financial performance for First Half Fiscal 2020,

(First time application of IFRS161)

"The First Half was better than we expected, with many positive signs in most segments that the underlying dynamics were improving."

"With the rapid spread of COVID-19 around the world, our focus is on protecting the health and safety of our people, consumers and clients and ensuring business continuity.

We have seen a significant number of sites fully or partially closed in Education, Corporate Services and Sports & Leisure, and the Olympics Games have been pushed back a year. We immediately identified all means to reduce our costs, reduce our capex and ensure that we collect and protect our cash to reduce the impact of this revenue shortfall. We are using all proposed government measures to protect employment. We know that this situation will have a significant impact on our results for the year.

I am extremely proud of our teams’ exemplary efforts and engagement and am convinced that the improved momentum in this first half will help us emerge stronger than we were before."

Highlights of the period

- First Half Fiscal 2020 Group revenue was 11,692 million euro, up +5.9%, helped by a positive currency and M&A contribution, resulting in Group organic revenue growth at +3.2%.

- On-site Services organic revenue growth was also +3.2% reflecting:

- A very successful Rugby World Cup in the first quarter, contributing 80 bps to the growth,

- Modest underlying organic growth excluding the Rugby World Cup in Q1 and Q2 (at +2.3% and +2.5% respectively) due to the end of several healthcare contracts in North America from the fourth quarter last fiscal year and a large contract exited from the middle of the first quarter this year.

- Key Performance Indicators are encouraging:

- Client retention is stable;

- New sales development declined by -10 bps;

- Same site sales growth is strong at +70 bps.

- Benefits & Rewards Services organic revenue growth was +4.0%. Organic growth in Europe remains sustained at +9.5% but Latin America has been impacted by weakness in Brazil, against a strong previous year performance and a very competitive environment.

- Underlying operating profit increased +5.9% resulting in an Underlying operating margin of 5.9%, stable against last year both at current and constant exchange rate:

- On-site Services Underlying operating margin, excluding currency effect, was down -10 bps resulting from increased medical costs in the USA, representing 14 bps. Excluding this, the margin would have been up slightly, with improvement in Business & Administrations and Healthcare compensating the deterioration in Education.

- Benefits & Rewards Services achieved a strong increase in margin of +160 bps, at constant rates, due to a much more efficient operating environment after substantial digital transformation of the back-offices over the last few years and very tight control of costs in Brazil, in line with the weak top line.

- Other operating expenses (net) amounted to 66 million euro, more or less stable compared to the First Half of the previous fiscal year.

- Reported net profit of 378 million euro was up +3.8%. Basic EPS was €2.59, up +3.7%. Underlying Net profit totalled 424 million euro, up +2.8%.

- Free cash flow this semester was an outflow of 243 million euro, principally as a result of an increase in capital expenditure to 268 million euro, or 2.3% of revenue, payable adjustments in the UK following the implementation of the prompt payment code, a cut-off issue in Benefits & Rewards and an outflow linked to the Rugby World Cup. Consequently, the net debt ratio at the end of the period was 1.3x against 1.2x at the end of the First Half last year.

- Sodexo’s commitment in corporate responsibility continues to be recognized within the financial community, with the highest marks in SAM’s “Sustainability Yearbook” for the 13th consecutive year, as well as gold class recognition by EcoVadis. Sodexo also remains the top-rated company in its sector within the Dow Jones Sustainability Index (DJSI), for the 15th consecutive year and was included in the 2020 Bloomberg Gender-Equality Index, recognizing commitment to advancing women in the workplace. Sodexo also joined The Valuable 500 initiative to place disability on the business agenda, reinforcing its commitments to disability inclusion.

Outlook

The COVID-19 pandemic started to be a concern in the second half of January for our business in China, leading to a rapid deterioration worldwide in February, moving from region to region and generating more and more government precautionary measures to limit the spread of the virus.

Sodexo is coordinating globally, regionally and locally to manage its business continuity and pandemic plans to support and protect its employees and consumers across all of its geographies. The health and safety of Sodexo employees and consumers is our utmost priority. Sodexo has reinforced the existing rules for food safety, personal hygiene and infection control.

As the situation is an evolving one, Sodexo teams are adhering to guidelines of health advisories and local authorities and will continue to closely monitor the situation.

As of today, On-Site services are expected to be impacted as follows:

- Education, we have estimated that Schools could restart gradually during the last term of the school year while most Universities are expected to remain close until the start of the new year.

- Business & Administrations

- Sports & Leisure volumes would be severely impacted throughout the second half.

- Corporate Services should be more varied in timing and present a more diverse set of scenarios.

- Energy & Resources and Government & Agencies should be only mildly impacted

- Healthcare & Seniors segment is currently impacted mildly in comparison to the others, and we are adapting rapidly to the demand of our clients in a very critical and stressful environment.

As for Benefits & Rewards Services, we believe there could be some decline due to technical unemployment measures and some disruption in both issuance and reimbursement flows in some geographies due to delays or diversion of traffic from one type of merchant to another.

As of April 9, 2020, for the Group, our top-line model show a reduction of revenues in the second half of between 2.4 and 2.8 billion euro compared to last year.

Sodexo is also mobilized to ensure business continuity and results through a set of rigorous actions focused on:

- Proactive cost management of our workforce to adapt to the rapidly changing contexts, redeployment of people to high-demand sites whenever possible, leveraging government employment initiatives, and strong control of SG&A

- Strict management of our cash position focused on maintaining an ongoing dialogue with clients to ensure timely payment as well as daily monitoring of cash positions, robust control of outflows, and cash pooling compliance

- Postponement of all Capex that is not strictly necessary and M&A until further notice.

At this stage, after these strong mitigating measures taken on-site and strict implementation of SG&A reductions, we estimate the Underlying operating profit flow-through to be circa 25% of revenue shortfall.

We remain confident on our strong market and financial position, and the mid-term positive perspectives and potential of Sodexo.

To read the full version of the press release, please download the PDF:

- Press release (PDF)

- Presentation (PDF)

The press release and presentation will be available on the Group website www.sodexo.com in both the "Latest News" section and the "Finance - Financial Results" section.

1 Please see section IFRS16 in the Activity Report.