Sodexo First Half Fiscal 2021 Results: rebound in profitability and strong free cashflow

At the Board of Directors meeting held on March 31, 2021 and chaired by Sophie Bellon, the Board closed the Consolidated accounts for the First half Fiscal 2021 ended February 28, 2021.

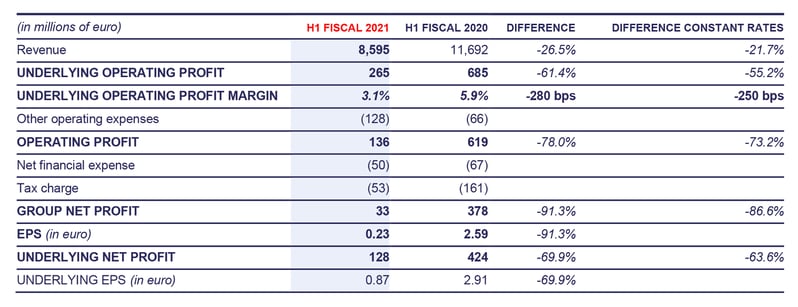

- Improving organic revenue trend quarter by quarter, at -21.7% for H1

- Underlying operating profit margin at 3.1%, large beat on assumptions

- Exceptional free cashflow generation for a first half

- Assumptions:

- H2 organic revenue growth between +10 and +15%

- H2 Underlying operating profit margin at around 3.1% at constant rate

- Cash conversion more than 100% for the full year

Financial performance for First Half Fiscal 2021

"Our actions to renegotiate our client contracts, strictly control our costs, and implement the GET restructuring program are clearly visible in our better than expected Underlying operating profit margin of 3.1%."

Denis MachuelSodexo CEO

"In the Second half, year on year organic growth rate will be very positive. However, given the new waves of the pandemic, we do not expect a significant improvement in revenue volumes from the first half. We are redoubling our efforts and focus on execution to offset the traditional seasonality gap between First and Second half Underlying operating profit margin.

We are confident that pent-up demand will ensure a strong pick-up in all segments and activities once the pandemic is over. I am very proud of how our organization is totally mobilized to fully benefit from these opportunities, and I warmly thank our teams for their impressive engagement in the field with our clients."

Highlights of the period

- First half Fiscal 2021 Group revenue was 8,595 million euro, down -26.5%, still significantly impacted by the Covid-19 crisis. The currency effect and in particular the weakness of the Dollar and the Real, accounted for -4.8%. The net M&A contribution was negligible. As a result, Group organic revenue decline was -21.7%, compared to -27.5% in Second half Fiscal 2020.

- On-site Services organic revenue decline was -22.2%, with consistent quarterly improvement, after a First quarter down -23.3%, or -22.1% excluding the Rugby World Cup effect, and Second quarter Fiscal 2021 down -21.0%. The key elements of the half-year were:

- In Business & Administrations, organic decline was -26.5%, still significantly impacted by the Covid-19 crisis due to the high level of working from home in Corporate Services and the number of closed sites in Sports & Leisure, and particularly in North America. Energy & Resources and Government & Agencies remained solid, up +4.3%, during the First half.

- Europe showed more resilience compared to North America. Asia-Pacific, Latam, Middle East and Africa region returned to growth.

- In Healthcare & Seniors, organic decline was -2.1%. Hospitals are still suffering from the pandemic related weakness in retail sales. However, the segment was boosted by the Rapid Testing Centers contract in the UK.

- In Education, organic decline was -31.9%. While there was a return to school from September in Europe and Asia, schools were predominantly closed in North America. Weak activity in Universities due to virtual learning was further impacted by a lower number of days, particularly in the second quarter due to a prolonged winter break.

- Key Performance Indicators for the First half were also impacted by the pandemic:

- Client retention was down -30 bps to 97.5%, impacted by the British Government’s return to self-operation of the Transforming Rehabilitation contract. Excluding this account loss, retention would have been up by +20 bps.

- New sales development was down -10 bps at 2.8%, but with much enhanced signing discipline, particularly regarding margins.

- Same site sales decline was at -22.7%, reflecting the substantial loss of food volumes, while Facilities Management Services remains solid.

- Benefits & Rewards Services was more resilient with an organic revenue decline of -8.1%. There was a slight deterioration in the second quarter trend, relative to the first quarter, due to the second wave lockdowns from November in most countries in Europe, delaying reimbursement volumes.

- Underlying operating margin was 3.1%, better than our assumptions and the -1.9% negative margin in Second half Fiscal 2020. This significant improvement in performance is the result of the many contract renegotiations since March 2020, prolonged furlough in some countries, the first results of the restructuring program and very strict cost control.

- Other operating expenses (net) amounted to 128 million euro, up significantly against the previous year, reflecting the implementation of the ongoing 350 million euro GET restructuring program started in the Second half last year. Restructuring costs amounted to 107 million euro, after 158 million euro in the Second half Fiscal 2020. The remaining 85 million euro is expected to be incurred in the Second half.

- Reported net profit was positive at 33 million euro and basic EPS was €0.23, both down -91.3% year on year. Underlying Net profit totaled 128 million euro, against the 424 million euro pre-crisis net profit in First half Fiscal 2020.

- Free cash flow at 237 million euro was much better than expected helped by a positive change in working capital of 41 million euro, boosted by strict management of receivables, Benefits & Rewards due to lower reimbursement flows, and continued Government support in terms of payment delays . In addition, net capex was exceptionally low at 86 million euro, due in particular to delays in client investments.

- Consequently, net debt has fallen year on year and since the beginning of the fiscal year to 1.7 billion euro, with the gearing ratio at 57%, against 50% pre-crisis in February 2020 and 67% in August 2020. The net debt ratio at the end of the period was impacted significantly by the reduction in the rolling twelve-month Underlying EBITDA, to reach 3.8x against 1.3x at the end of First half Fiscal 2020 and 2.1x at the end of Fiscal 2020.

- During the quarter, Sodexo reinforced its commitment to reducing its environmental footprint:

- Sodexo joined the Climate Group's RE100 initiative, committing to switch to 100% renewable electricity by 2025. This commitment covers Sodexo’s directly operated sites under the Scope 1 and Scope 2 activities as per the GHG Protocol guidelines.

- Since March 1, 2021, Sodexo has been phasing out five key single-use plastic Foodservice items from its on-site operations in Europe, with only paper, cardboard, wood or fiber-based options available in its supply catalog. The move goes beyond upcoming EU legislation by removing takeaway bags in addition to straws, plates, cutlery and stirrers.

- In March 2021, Sodexo entered the new Euronext CAC40 ESG index, created in response to the growing market demand for sustainable investments. Being part of the index recognizes Sodexo commitment and initiatives for a sustainable global economy.

Outlook

While confidence is high in a rapid recovery once vaccination is fully deployed, in the short-term, the situation remains volatile, particularly in Europe with the new waves of the pandemic.

As a result, we expect little improvement in the quarter on quarter trends through to the fiscal year end in August.

The Group will continue to renegotiate its contracts to ensure the best possible level of profitability, to deliver its restructuring measures and activate all government support available.

In this context,

- Second half Fiscal 2021 organic growth is expected between +10 and +15%.

- After the strong performance in the First half, cost containment and restructuring should offset the traditional seasonality gap between First half and Second half margins, so that the Second half Fiscal 2021 underlying operating margin should be around 3.1%, at constant rates.

- After an exceptional free cashflow performance in the First half, our objective for the year is to achieve a cash conversion of more than 100%.

Looking further out, on the basis that the pandemic will be over by 2021 calendar year end, the Group aims to return to sustained growth and to rapidly increase the Underlying operating margin back over the pre-Covid level.

The Board and the Executive Committee extend their sincere thanks to all employees who have collectively contributed to the improved financial performance in First half Fiscal 2021.

To read the full version of the press release, please download the PDF:

- Press release (PDF)

- Presentation (PDF)

The press release and presentation will be available on the Group website www.sodexo.com in both the "Latest News" section and the "Finance - Financial Results" section.

Conference call

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its for H1 Fiscal 2021 results. Those who wish to connect

- from the UK may dial +44 (0) 2071 928 338, or

- from France +33 (0) 1 70 70 07 81, or

- from the USA +1 646 741 3167,

- followed by the passcode 52 65 589.