Sodexo: First half Fiscal 2022 Results up strongly

At the Board of Directors meeting held on March 31, 2022, and chaired by Sophie Bellon, the Board closed the Consolidated accounts for the First half Fiscal 2022 ended February 28, 2022.

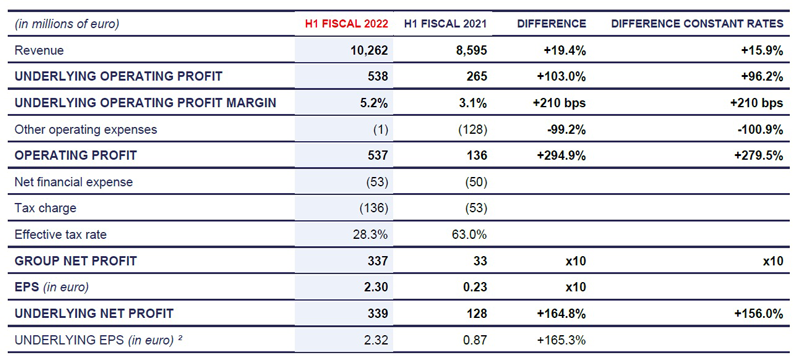

- Revenue growth +19.4%, despite Omicron, organic growth +16.7%

- Underlying operating profit doubled, H1 margin at 5.2%, up +210 bps

- Fiscal 2022 guidance

- Organic revenue growth around the bottom of the range of +15% to +18%

- Underlying operating profit margin close to 5%, at constant rate

Financial performance for First half Fiscal 2022

"Revenue growth and margins improvement have been strong in this First half, reflecting the solid recovery in Education, Corporate Services and Sports & Leisure segments."

"Omicron did have an impact on the recovery in the second quarter, but we are seeing a pick-up since the end of February.

We have closed the GET efficiency program, with better results than anticipated. The teams mobilized actively to implement measures to mitigate rising cost inflation: indexation, client negotiations, productivity, product substitution. These actions resulted in a +210 bps improvement of our Underlying operating profit margin to 5.2%.

Since October 2021, we have made significant progress on our strategic priorities. Operational execution and sales development are improving in the United States. More new food model offers are being deployed in our major geographies. Our disposals and acquisitions are fully aligned with our portfolio strategy. The transfer of the management of Schools and Government & Agencies to the regions is a first step in the simplification of our organization.

In the second half of the year, we are confident that the return to the workplace and Sports & Leisure events will continue to recover. However, the environment remains uncertain with intermittent local outbreaks of Covid-19, and the war in Ukraine. We are confident that we can manage the year end inflationary pressure on margins. Currencies should give us a nice tailwind, but we expect organic revenue growth to be around the bottom of the range we had given in October 2021.

Our teams are mobilized to meet the challenges and I warmly thank them for their impressive engagement in the field with our clients and our suppliers. We remain confident in our capacity to continue to grow our business."

Highlights of the period

- First half Fiscal 2022 Group revenue was 10,262 million euro, up +19.4%, with strong recovery coming through in all segments that were severely impacted by Covid. The currency effect was strong at +3.5%, resulting from the strength of all our major currencies against the euro. The net M&A contribution was -0.8% due to the exit of businesses, sold as part of the portfolio management program. As a result, Group organic revenue growth was +16.7%, back up to 95% of pre-Covid levels.

- On-site Services organic revenue growth was +17.0%, with a particularly strong first quarter up +17.9% and a second quarter at +16.1%, impacted by Omicron. The recovery was solid with the first quarter ending at 95 % of pre-Covid levels but falling back slightly to 94% in the second quarter due to Omicron. The key elements of the half-year were:

- In Business & Administrations, organic growth was +19.5%. It reflects a strong recovery in Corporate Services, back up to 89% of pre-Covid levels in Q2, due to a gradual but regular return to the workplace. Sports & Leisure is back up to 61%, as the number of events has picked up significantly. Energy & Resources and Government & Agencies remained solid.

- In Healthcare & Seniors, organic growth was +5.0%, with the first quarter up +7.4% and the second quarter up +2.5% reflecting a much tougher comparative base in Europe, including a high level of activities at the Testing Centers contract in the United Kingdom last year.

- In Education, organic growth was +29.5%. While the recovery in activity in Universities in North America was very strong during the period, Omicron did have an impact on the growth in the second quarter in Schools in North America and Europe. Relative to pre-Covid levels, Education was at 88% in the second quarter, back down from 92% in the first quarter, impacted also by the full effect of the Chicago Public Schools contract termination.

- Key Performance Indicators for the First half Fiscal 2022:

- Client retention was up +60 bps to 98.1%, improving in all regions and segments.

- New sales development was up +90 bps at 3.7%, with improvements in many regions, including North America. The higher levels of signings were combined with continued signing discipline, particularly regarding the average projected gross margin which is up +80 bps.

- Same site sales growth recovered strongly at +19.8%, as volume recovery came through, helped by some solid cross-selling in many segments and regions.

- Benefits & Rewards Services organic growth was +9.3%, with Employee benefits up a strong +14.5%. There was an acceleration in the second quarter in both the Europe, USA and Asia region and Latin America, where Brazil is also back to double digit growth.

- Underlying operating margin was 5.2%, up +210 bps versus First half Fiscal 2021. This significant improvement in performance is the result of the strong recovery in volumes, the successful completion of the GET efficiency program, and strong actions to mitigate inflation through indexation, contract renegotiations and productivity.

- Other operating expenses (net) amounted to only 1 million euros in First half Fiscal 2022, with restructuring costs falling to 3 million euros and gains on the sale of assets more or less off-setting losses. This compares to 128 million euros in the previous year.

- The Effective tax rate at 28.3% fell below 30%, back to a more regular rate.

- Group net profit recovered significantly at 337 million euros against 33 million euros in the previous year. Basic EPS was thus multiplied by 10 at €2.30 against €0.23 in the previous year. Underlying Net profit increased +164.8% to 339 million euros against 128 million euros in the previous year.

- First half Fiscal 2022 Free cash outflow was 75 million euros against the cash inflow of 237 million euros in the previous period. The previous year was boosted by delayed restructuring costs and government payment delays. This year performance was marred by the unwinding of these same government payment delays and restructuring costs combined with the reimbursement of Tokyo Olympics ticketing and an exceptional contribution to the United Kingdom pension funds. Recurring free cash flow was 182 million euros, after a significant increase in capex to 159 million euros, or 1.5% of revenues, relative to the exceptionally low level of 86 million euros, or 0.9% of revenues in the previous year.

- Net debt has risen year on year to 2.0 billion euros from 1.7 billion euros. However, gearing2 is stable at 56% and as a result of the significant improvement in EBITDA, the net debt ratio has fallen back down to 1.8x compared to 3.8x at the end of First half Fiscal 2021.

- Once again, our Corporate Responsibility achievements have been externally recognized:

- Sodexo earns its 15th consecutive 100 on the Human Rights Campaign Foundation’s annual assessment of LGBTQ+ workplace equality.

- Sodexo is ranked #1 of the food service sector in World Benchmarking Alliance’s (WBA) first Food and Agriculture Benchmark, which measures how the world's 350 most influential companies in the industry are transforming the food system for a more sustainable future.

- In February 2022, Sodexo was awarded Supplier Engagement Leader by CDP, placing us in the 8% top companies taking action to measure and reduce environmental risks within its supply chain.

- Strategic priorities

- Boost US growth:

- Sales momentum is developing with robust new development, an increase in the active pipeline, which should support stronger sales in the second half and solid retention. First time outsourcing contract signings are increasing and currently represent circa 40% of signatures in the First half.

- Investment in the Marketing & Sales resources is continuing with additions of new sales executives and managers and the recent launching of a new digital training program.

- A specific long-term incentive scheme for the North America leadership team has been launched to strengthen collective and individual accountability.

- Accelerate the food model transformation:

- The deployment of On-site brands & offers is accelerating with the scale-up of The Good Eating Company in the United States and new contracts signatures in the tech and finance sectors for Nourish, Fooditude and The Good Eating Company.

- We are developing partnerships with high-end brands such as an exclusive 10-year partnership with ForFive Coffee, a premium coffee and food company based in New York.

- The digitalization of the consumer experience is also progressing. In China, we are leveraging the Meican digital online ordering, mobile apps, smart waiter… to enhance the food offer and develop new smaller clients. We have signed an agreement to expand the Kiwibot fleet in 50 US universities by the end of the year.

- We are progressively transforming production & logistics: with our new branded offsite kitchens such as Fooditude, Nourish, Frontline Food Services but also with our new central production units in Boston or in Beijing.

- Manage more actively our portfolio:

- A number of strategic acquisitions & investments have been completed during the period:

- To expand the New Food Model offerings, we have acquired Frontline Food Services in North America and increased our participation in Meican in China.

- To strengthen our European GPO (Group purchasing organization), two investments have been made in Europe.

- To enhance our value-added offers in Healthcare, a Technical Equipment management service company has been acquired in China.

- Divestment of non-core activities and geographies have also accelerated in the First half. In On-site Services, subsidiaries in Morocco, non-strategic account portfolios in Australia and Czech Republic and The Lido in France have all been sold. Benefits & Rewards Services disposed of its Russian activity and also the sports-cards in Romania and Spain. The Global Childcare activities and On-site Services in the Congo were closed in March. As a result, the Group has now reduced its presence down to 55 countries at the end of February 2022.

- A number of strategic acquisitions & investments have been completed during the period:

- Enhance the effectiveness of our organization:

- The GET efficiency program closed ahead of plan with 382 million euros of savings against the target of 350 million euros and a savings/cost ratio of 117% versus 100%.

- The reorganization of Government & Agencies and Education to be managed regionally has simplified the organization, and as a result two Global CEO positions have been removed from the Executive Committee.

- In the Executive Committee, Annick de Vanssay, interim Chief People Officer since September 2021, is now appointed as Group Chief Human Resources Officer and Alexandra Serizay, previously Chief of Staff of Sophie Bellon, is appointed Group Chief Strategy Officer.

- Boost US growth:

- Ukraine war

- Sodexo does not have activities in Ukraine.

- Sodexo has a small On-site presence in Russia: less than 1% of Group revenues. The situation is being monitored closely and we are reviewing different options at the moment.

- From the beginning of the war, Sodexo has been strongly mobilized to ensure business continuity for its clients, guarantee the safety of its employees, and provide support to the refugees in countries bordering Ukraine. Sodexo Group and Stop Hunger have set up a Sodexo Employee Donations Global Initiative with the support of their long-term partner, the United Nations World Food Programme (WFP). Employee donations are matched by Sodexo and the money raised will be used to support refugees in the region and people affected by the war in Ukraine.

Outlook

The First half Fiscal 2022 benefited from a strong recovery, post-Covid, in the Corporate Services, Sports & Leisure and Education segments but it was also impacted by Delta and Omicron in the second quarter. Since the end of February, momentum is picking back up. However, the current environment remains full of uncertainties. There is a resurgence of localized Covid outbreaks, several mobilizations in Russia will not happen, and the Testing Centers in the United Kingdom are closing earlier than expected.

As a result, we expect

- Fiscal 2022 organic growth to be around the bottom of the range of +15% to +18% given in October 2021.

The currencies provided a strong tailwind in the First half and, at today’s rates, should continue to do so.

Our teams have successfully managed the margins in the First half and are highly mobilized to mitigate all these uncertainties and in particular the additional inflation resulting from the disruption to the supply chain due to the Ukraine war.

As a result, we maintain our expectations for

- Fiscal 2022 Underlying Operating Profit margin close to 5%, at constant rates.

To read the full version of the press release, please download the PDF:

- Press release (PDF)

- Presentation (PDF)

The press release and presentation will be available on the Group website www.sodexo.com in both the "Latest News" section and the "Finance - Financial Results" section.

Conference call

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its H1 Fiscal 2022 results. Those who wish to connect

- from the UK may dial +44 2071 928 338, or

- from France + 33 1 70 70 07 81, or

- from the USA +1 646-741-3167,

- followed by the access code 92 69 446