Sodexo Fiscal 2025 results in line with revised guidance; Fiscal 2026 as a transition year laying foundation for the future

At the Board of Directors meeting held on October 23, 2024, chaired by Sophie Bellon, the Board closed the Sodexo Consolidated accounts for Fiscal 2024 ended August 31, 2024.

“2024 has been a year of structural transformation with two decisive steps to further focus the Group : the spin-off of Pluxee and the unwinding of the cross-shareholding with Bellon SA, returning the proceeds to shareholders. With our simplified structure, reorganized by geography, as a pure-player in Food and FM services, we are mobilized on enhancing our operational execution to drive profitable and sustainable growth.

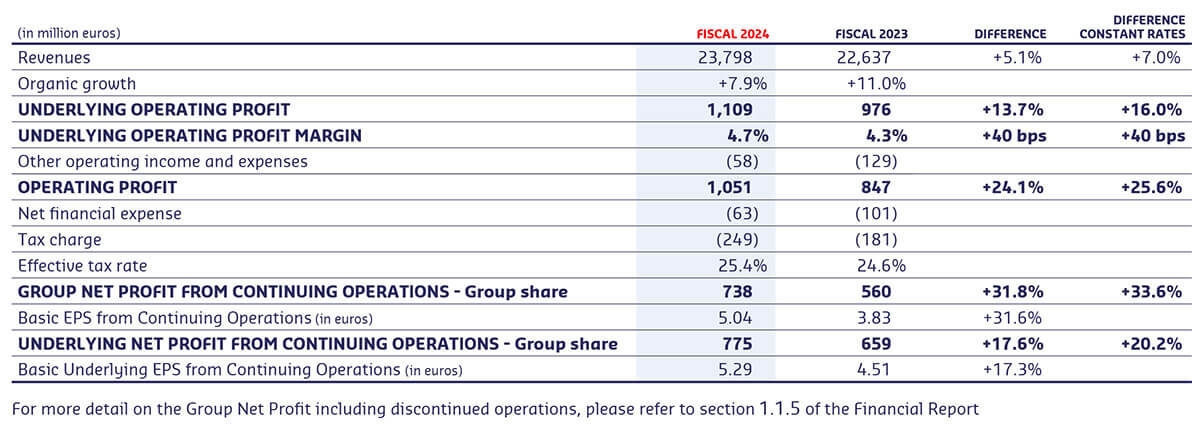

We delivered a strong set of numbers, at the top-end of our guidance, achieving organic growth of +7.9% and a 40 bps improvement in margins. This was driven by effective inflation management, positive net new business, a standout year for Sodexo Live! and strong operating leverage from productivity gains, supply chain momentum and cost reduction. Finally, we reduced our Net debt to EBITDA ratio to 1.7 times, firmly back within the target range.

We achieved a record year for new signings, exceeding 1.9 billion euros including cross-selling, and at above-average margins. While retention was impacted by the loss of a large global contract, our disciplined approach and structural improvements have laid strong foundations. We are determined to recover our trajectory at over 95% already in Fiscal 2025.

Looking forward, I am confident that our progress on deploying our culinary food expertise through our food brands and our new production and distribution models, combined with strong digital features, will help us make a difference for clients and consumers. In the meantime, we are reaping the fruits of our efforts to optimize our supply management, and we are continuing to seek out efficiencies.

I want to thank our teams for their hard work and dedication in driving the Group's transformation."

By geography:

In Fiscal 2024, Sodexo’s solid financial performance was accompanied by continued progress on its sustainability commitments:

At the Shareholders meeting on December 17, 2024, approvals of the following resolutions will be proposed:

All the resolutions and Governance details will be presented in the Universal Registration Document to be filed with the AMF (French stock market authorities) on November 5, 2024.

Looking ahead to Fiscal 2025, we anticipate sustained growth and continued margin improvement.

Growth will be driven by:

We will drive further efficiencies and support margin improvement by our disciplined commercial approach, investments in data and digital, supply management optimization, deployment of our branded offers, and scaling of new production and distribution models, combined with rigorous cost control and reinforced efficiency of our support services.

As a result, our guidance for Fiscal 2025 is as follows:

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on these Fiscal 2024 results.

Those who wish to connect:

Access Code: 07 26 13

A live audio webcast is also available on www.sodexo.com.

These dates are indicative and may be subject to change without notice. Regular updates are available in the calendar on our website www.sodexo.com

1 Excluding the base effect of the Olympics, the Rugby World Cup and leap year in Fiscal 2024

2 New definitions of Net Capital expenditure and EBITDA, please refer to section 1.2.10 of the Financial Report.

3 Net debt as of August 31, 2023, was adjusted to reflect the post spin-off situation, please refer to section 1.2.2 of the Financial Report.

Sodexo Fiscal 2025 results in line with revised guidance; Fiscal 2026 as a transition year laying foundation for the future

Sodexo Q3 Fiscal 2025 revenues in line with expectations

Sodexo Inc. successfully completes its new US dollar notes issuance and its tender offer