Sodexo Fiscal 2025 results in line with revised guidance; Fiscal 2026 as a transition year laying foundation for the future

At the Board of Directors meeting held on April 18, 2024, chaired by Sophie Bellon, the Board closed the Consolidated accounts for the First half Fiscal 2024 ended February 29, 2024.

For more detail on the Group Net Profit including discontinued operations, please refer to section 1.2.6 of the Financial Report.

The spin-off of Pluxee has been successfully completed. Sodexo is now a pure-player in Food and Facilities Management services!

We are making progress in transforming our Food services, developing our branded offers, boosting our convenience activity and enhancing our purchasing, particularly in North America. Our organization has been considerably simplified and streamlined: we are gaining in agility.

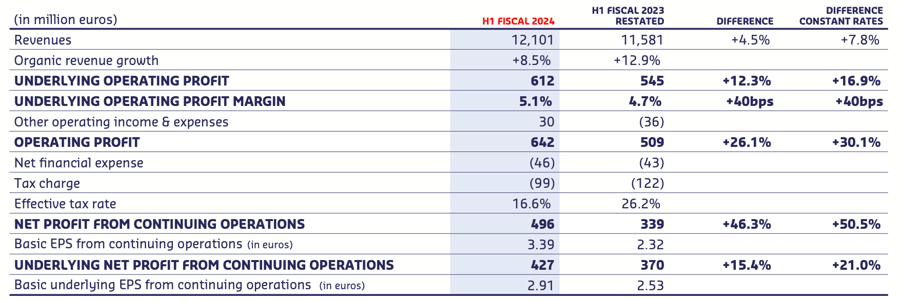

The first half performance is solid. Organic growth is robust and the margin is up +40bps. Net new business momentum is also solid with a further improvement in retention.

We are progressing towards our ambition to be the world leader in sustainable food and valued experiences. I would like to thank all our teams, who have worked so hard to execute the spin-off of Pluxee while delivering a solid operational performance!

First half Fiscal 2024 consolidated revenues were at 12.1 billion euros, up +4.5% year-on-year. Acquisitions and disposals impacted growth by -0.7%, linked to the sale of the Homecare activities in October only very partially offset by some bolt-on acquisitions, particularly in North America convenience. The negative currency impact amounted to -3.3%. As a result, organic revenue growth was +8.5%.

(1) New definitions of Net Capital expenditure and EBITDA, please refer to section 1.1 of the Financial Report.

(2) Net debt as of August 31, 2023, was adjusted to reflect the post spin-off situation, please refer to section 1.3.3 of the Financial Report.

Sodexo has been strengthening its approach by:

Once again Sodexo’s continued progress has been recognized externally as it is the only Food services company included in:

Given the solid commercial momentum, some ongoing volume growth, the contribution of the Paris Olympics and Paralympics Games in the fourth quarter, and pricing expected at close to +4% for the full year, Fiscal 2024 guidance is:

Sodexo will hold a conference call (in English) today at 9:45 a.m. (Paris time), 8:45 a.m. (London time) to comment on its First half Fiscal 2024 results.

Those who wish to connect:

Followed by the access code 07 26 13.

The live audio webcast will be available on www.sodexo.com

The press release, presentation and webcast will be available on the Group website www.sodexo.com in both the “Newsroom” section and the “Investors – Financial Results” section.

These dates are indicative and may be subject to change without notice. Regular updates are available in the calendar on our website www.sodexo.com

Sodexo Fiscal 2025 results in line with revised guidance; Fiscal 2026 as a transition year laying foundation for the future

Sodexo Q3 Fiscal 2025 revenues in line with expectations

Sodexo Inc. successfully completes its new US dollar notes issuance and its tender offer