Sodexo Fiscal 2025 results in line with revised guidance; Fiscal 2026 as a transition year laying foundation for the future

“While our industry fundamentals remain strong, in North America the continued soft trend in volumes in Education and slower than expected net new ramp-up in Healthcare have impacted our ability to meet initial expectations. We are determined to strengthen execution on identified areas where improvement is required. We continue to see significant opportunities in a highly attractive market, and we are investing in the future to grow faster. We are confident in our ability to create sustainable value for our stakeholders.”

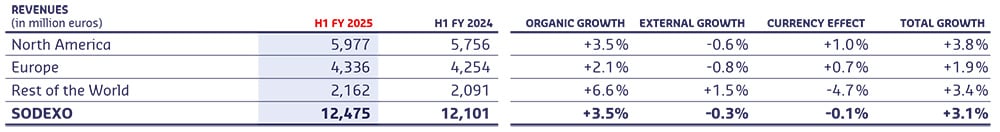

Our adjustment to the full-year organic revenue growth guidance is primarily driven by weaker-than-expected volume trends in Education in the First half, which are expected to persist. Additionally, in North America, delays in certain contracts start dates in Healthcare, and softer commercial performance in the First half have impacted expectations for net new contributions in the second half.

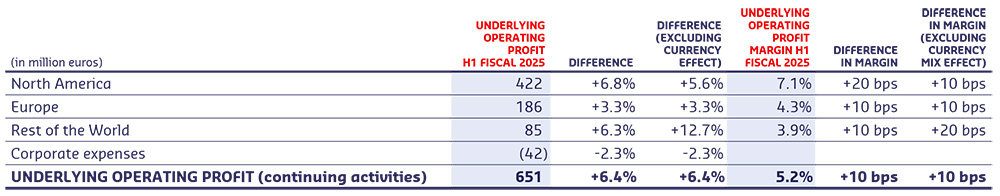

Similarly, the revision of the Underlying operating margin guidance mainly reflects the full-year impact of the revenue shortfall.

Sodexo is strengthening execution on identified areas where improvement is required, with a particular focus on North America towards commercial discipline and operational execution, as well as global organizational efficiency and strict overhead cost control.

Further details will be provided in the upcoming H1 results announcement, scheduled for April 4th, 2025.

Sodexo will hold a conference call (in English) today at 8:30 a.m. (Paris time), 7:30 a.m. (London time) to comment on this release.

Those who wish to connect:

Followed by the access code 07 26 13.

The live audio webcast will be available on www.sodexo.com, watch the webcast here.

Sodexo Fiscal 2025 results in line with revised guidance; Fiscal 2026 as a transition year laying foundation for the future

Sodexo Q3 Fiscal 2025 revenues in line with expectations

Sodexo Inc. successfully completes its new US dollar notes issuance and its tender offer