Sodexo: strong financial delivery in Fiscal 2024

Commenting on the third quarter activity

"Our third quarter On-site activity continued to grow strongly, despite the much higher comparative base. We continue to have momentum in contract wins and retention. There was some further post-Covid ramping up in the return to the workplace and in event attendance and average spend.

Pluxee third quarter growth is stronger than expected with growing underlying demand, amplified by strong face value increases and higher interest rates.The workstreams associated with the spin-off are on track. We endorsed the appointment of Didier Michaud-Daniel as future Chairman of the Board of Pluxee who will work closely with Aurélien Sonet, the CEO, and Stéphane Lhopiteau who is joining Pluxee as CFO.

We are progressing towards our 2025 ambition to become leader in sustainable food and valued experiences. I want to thank all the teams for their dynamic mobilization around our strategic projects."

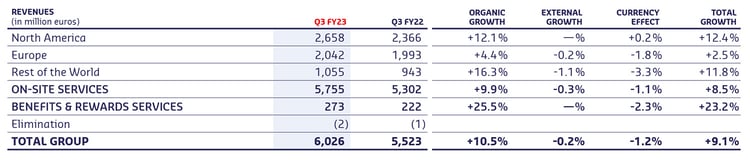

Pluxee (Benefits & Rewards Services) organic growth was +25.5%. Operating revenues organic growth at +16.7% continued to accelerate in the third quarter, fueled by positive net development and face value increases. The trajectory on financial revenues remained very strong, benefiting from the continuous increase in euro interest rates.

Our Fiscal 2023 guidance has been refined to reflect the strong Pluxee performance and solid in-line performance of On-site Services in the third quarter:

Sodexo: strong financial delivery in Fiscal 2024

Sodexo announces the completion of the sale of Sofinsod for € 918 million and the payment of a special interim dividend

Sodexo is pleased to announce the simplification of its ownership structure and payment of an interim dividend of €6.24 per share