Sodexo: strong financial delivery in Fiscal 2024

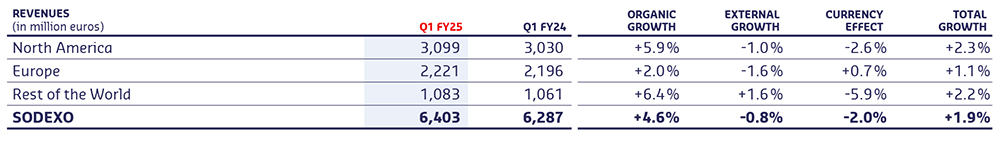

" As we reflect on the first quarter, we have delivered organic growth of +4.6%, marking a soft start to the year as expected. Solid performance in Food services offset softer activity in FM services, where we experienced lower volumes in project works.

Importantly, we are encouraged by the strong commercial momentum at the start of the year, marked by major contract wins and renewals.

Aligned with our expectations of modest growth in the first half of the year and an acceleration in the second half, driven by the timing of net new business contributions, we are committed to delivering on our guidance for the year.

Together with our talented teams, we are confident in our ability to continue to drive sustainable growth while delivering positive impact for all our stakeholders, in line with our ambition to be the world leader in sustainable food and valued experiences."

Given our expectation of modest growth in the first half of the year and an acceleration in the second half, supported by the strong commercial momentum observed at the start of the year and the timing of net new business contributions, the full-year guidance is maintained:

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its Q1 Fiscal 2025 revenues.

Those who wish to connect:

Followed by the access code 07 26 13.

The live audio webcast will be available on www.sodexo.com

1 Excluding Rugby World Cup last year, partially offset by the Paralympics this year

Sodexo: strong financial delivery in Fiscal 2024

Sodexo announces the completion of the sale of Sofinsod for € 918 million and the payment of a special interim dividend

Sodexo is pleased to announce the simplification of its ownership structure and payment of an interim dividend of €6.24 per share