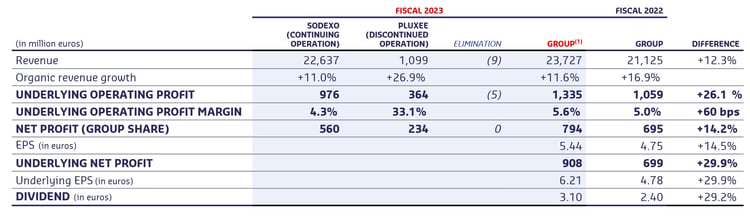

Sodexo Fiscal 2023 key figures and highlights (with Pluxee as discontinued operation)

Given the proximity of the Pluxee spin-off and the support from Bellon SA for the operation, Pluxee is accounted for as a discontinued operation and therefore is consolidated in the P&L at the net profit level. As a result, the commentary down to net profit includes only the Sodexo continued operations.

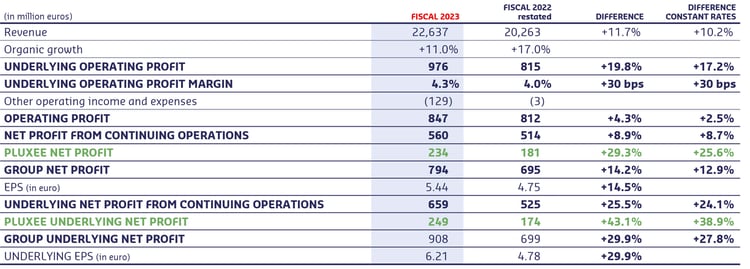

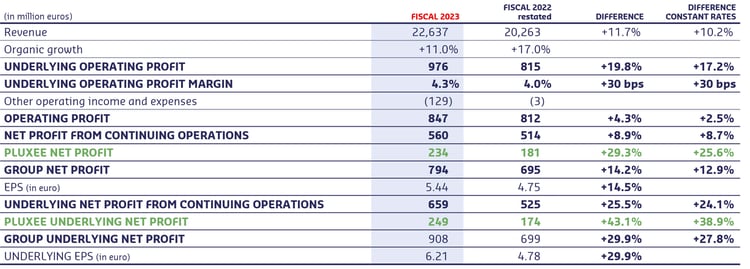

- Sodexo continued operations Fiscal 2023 consolidated revenues reached 22.6 billion euros, up +11.7% year-on-year driven by organic growth of +11%, a positive currency impact of +1.5% and a net contribution from acquisitions and disposals of -0.8%.

- The First half benefited from the ongoing post-Covid recovery and more than 5% pricing, to pass inflation. Growth remained very solid in the second half, at +9.9% in Q3 and +8.1% in Q4, due to ongoing volume growth in most segments and geographies and continued pricing contribution of more than 5%. Excluding an accounting change related to the revenue recognition in a large contract which impacted the fourth quarter by -2.3%, Underlying organic growth exit rate was in fact +10.4% in the fourth quarter, a positive trend for beginning of Fiscal 2024.

By geography, for the full year:

- In North America, organic growth was +13.9% with strong growth in all segments, and in particular in Business & Administrations due to the continued return to office and strong attendance and average spend in Sodexo Live!

- In Europe, organic growth was +7.5%, or +10.6% excluding the end of the testing centers contract in the UK. All segments contributed even though Education was impacted by strikes in Q3 and delayed price increases, particularly in France.

- In Rest of the World, organic growth was +11.5%, or +14.6% excluding the accounting adjustment. Growth was very strong in all regions in Corporate Services and Energy & Resources, except in China where the post-Covid macro economic environment is impacting Business & Administrations. Education growth was very strong in India and China.

- Solid net new signings:

- Client retention rate was a record 95.2%, +70 bps higher than the previous year which was already a record level.

- New development was 7%, in the 7-8% range. New wins including cross-selling reached 1.7 billion euros up against 1.5 billion euros the previous year, and with enhanced profitability.

- As a result, the net new business signed during the year was positive at 2.2% compared to 2% in the previous year and this will contribute to Fiscal 2024 growth.

- Sodexo continued operations Underlying operating profit was 976 million euros, up +19.8% and the Underlying operating margin was 4.3%, up +30 bps. This significant increase in margin was due to an improvement in North America of +30 bps and Rest of the World of +40 bps offsetting a -20 bps reduction in Europe. This zone was temporarily impacted by delays in passing through price increases in the public sector in France, Italy and Belgium, and the end of the testing centers contract which had a high flow-through. HQ costs were also down significantly.

- Sodexo continued operations Other operating expenses (net) amounted to 129 million euros against 3 million euros in Fiscal 2022. This year, the costs were linked to restructuring due to the change in organization, M&A costs and one-off Pluxee spin-off costs.

- Sodexo continued operations Net Income was 560 million euros, up +8.9% and Underlying net profit was 659 million euros up +25.5%.

- Pluxee contributed 234 million euros to Net profit in Fiscal 2023, up +29.3% year-on-year, and 249 million euros to Underlying net profit, up +43.1%. The significant increase in this contribution reflects the combination of +26.9% organic revenue growth, boosted by higher interest rates, higher face values, strong new business in most regions and, regulation changes in Brazil. The Underlying operating margin increase was also substantial, up +450bps improvement to 33.1%.

- As a result, Sodexo Net profit reached 794 million euros and Underlying net profit 908 million euros, resulting respectively in an EPS of 5.44 euros and 6.21 euros.

- The Board proposes a dividend of 3.10 euros, up +29%, representing a pay-out ratio of 50%, in line with Sodexo's dividend policy. This will be proposed at the Shareholders meeting on December 15, 2023.

- Sodexo continued operations Free cash flow was 374 million euros up from 326 million euros the previous year and despite a 33% increase in Capex, linked to some particularly large client investments. Gross capex was 520 million euros, or 2.3% of revenues against 2% in Fiscal 2022. Pluxee free cash flow was also very strong at 438 million euros, up from 305 million euros in Fiscal 2022. As a result, Group total Free cash flow was 812 million euros

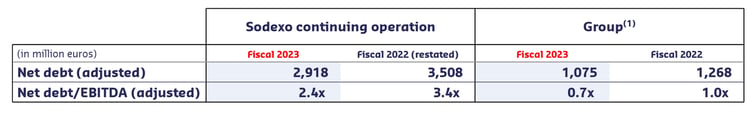

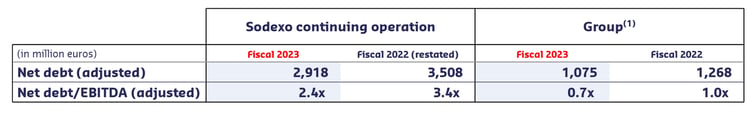

- Sodexo continued operations Net debt (adjusted to reflect the post-spin-off situation) was

2.9 billion euros at the end of the year. Both Sodexo continuing operations and the Group(1) showed strong deleveraging during Fiscal 2023. Sodexo will continue to target a mid-term range of 1-2x for the net debt ratio.

- In anticipation of the full spin-off of Pluxee, Sodexo has elected to redeem, on November 10, 2023 all of its 300 million euros 1.125 per cent Bonds series due May 22, 2025 pursuant to the terms and conditions of these Bonds.

CSR results mirror the good financial performance

In Fiscal 2023, Sodexo’s solid financial performance was accompanied by continued progress on its sustainability commitments:

- Record performance on safety of our People. At the end of Fiscal 2023, Sodexo reached a record 0.55 Lost Time Injury Rate (LTIR), representing a -15.4% reduction compared to Fiscal 2022. The severity of Lost time injuries also reached a record level reduction of -52% compared to the previous year.

- 82.5% Employee engagement confirming renewed confidence in Sodexo and its trajectory. The engagement rate was up +4.2 points compared to 2021, exceeding the 2025 objective of 80%. For this 10th engagement survey, the participation rate reached an all time high of 70.3%, up +10.3 points compared to the 2021 survey, with 243,000 participants across the Group.

- Increased share in renewable electricity in our direct operations. Further progress has been achieved in the share of the Group’s direct electricity consumption that is renewable at 55%, well above the 40% target for the year and therefore facilitating the achievement of our target of 100% by 2025.

- The year-on-year Scope 1, 2 and 3 reduction in GHG emissions was -5.4% in Fiscal 2023 while the reduction compared to 2017 was at -20.7%. Sodexo emissions targets have been validated by the SBTi in 2019. Because our journey started early on and following the SBTi guidelines, Sodexo has rebased its emissions since 2017. The effect of this rebaselining implies a significant reduction of the 2017 baseline numbers. As a result, at the end of Fiscal 2023, Scope 1&2 GHG emissions are down -32.9% relative to the new 2017 base line, on track to reach our reduction target of -34% in 2025. The Scope 3, -34% reduction target should be reached in Fiscal 2026. The current reduction trajectory is aligned with the SBTi recommended pathway for the 1.5° trajectory.

Sodexo Governance

At the Shareholders meeting on December 15, 2023, the following renewals and appointments will be proposed:

- Sophie Bellon, who should she be reelected will then be reappointed Chairwoman and CEO.

- Nathalie Bellon-Szabo, who will then be confirmed as member of the Nominating Committee.

- Federico J. González Tejera, who will then be confirmed as member of the Compensation Committee.

- Francoise Brougher's term expires after the 2023 Shareholders meeting. No longer considered as an independent Director, she will not be seeking renewal. Sophie Bellon and the other members of the Board thank her for her very dedicated support of and strong contribution to the Company and the Board over these last 12 years.

- The appointment of a new independent Director, Gilles Pélisson will be presented for election at the Shareholders meeting. Since 2016 and until recently, Gilles Pélisson was Chairman of the Board and Chief Executive Officer of the commercial television network and production group, TF1. Before joining TF1, Gilles Pélisson was Chairman and CEO in several international, listed companies such as Accor, Euro Disney and Bouygues Telecom. Gilles Pélisson was also board member for Bic, Lucien Barrière Group, NH Hoteles and Sun Resort International. He is currently the Lead independant director of Accenture PLC (United States) and Chairman of the Lyfe Institute (formely Paul Bocuse Institute), a management school in hospitality and culinary arts. Gilles Pélisson will bring 40 years of extensive operational experience in international environments in the services industry, as well as a thorough understanding of corporate governance. Should his appointment be approved at the Shareholders meeting, he will become Chairman of the Nominating Committee.

- As part of the review of the committees, the Board of Directors endorsed the appointment of François-Xavier Bellon and Jean-Baptiste Chasseloup de Chatillon as members of the Compensation Committee.

Sodexo* Outlook

*excluding Pluxee

Given the strategic progress made in Fiscal 2022 and 2023, Sodexo is on track to pursue its recovery in North America, enhance efficiency and agility, continue to transform the food offers and operations and grow selectively in Facilities Management. Commercial excellence, data and digital investments and supply management support, will all contribute to better commercial momentum and better margins.

The Underlying revenue organic growth exit rate in the fourth quarter of Fiscal 2023 was over +10%.

With continued inflation being passed through, pricing is expected to average out at 3-4% for Fiscal 2024. The contribution from net new business should be above 2%, amplified by cross-selling.

As a result, Sodexo (excluding Pluxee) Fiscal 2024 and 2025 guidance:

- Organic revenue growth should be between +6 and +8% per annum;

- Underlying operating profit margin should continue to grow by +30-40 bps per annum, at constant rates.

Pluxee full Spin-off

The project to spin-off Pluxee has advanced significantly.

The listing is expected early 2024 on Euronext Paris, subject to approval of the listing prospectus by the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten) and its passporting to the French Autorité des marchés financiers, the Euronext admission decision and market conditions.

Existing double voting rights of Sodexo shareholders will be maintained at Pluxee, which will be legally registered in the Netherlands allowing Bellon SA to continue playing a long-term controlling shareholder role in Pluxee. Tax residency will remain in France.

The proposed full spin-off will be put to a shareholder vote during a dedicated General Meeting to be held early 2024.

Pluxee plans to hold a Capital Markets Day shortly before the dedicated General Meeting to present its strategic plan and the next phase of value creation. The Fiscal 2024 and mid-term guidance will be provided on this occasion.

The spin-off will have no significant tax impact for Sodexo and its shareholders, at least in France and in the USA.

Pluxee will be allocated a portion of Sodexo's current indebtedness for a total amount of 0.6 billion of euros and Pluxee proforma capital structure will be consistent with a strong Investment Grade credit rating.

The Board of Pluxee will be comprised of:

- an Executive Chairman: Didier Michaud-Daniel;

- 4 Bellon family Board members;

- 5 Independent Board members.

The Animation (services) contract between Bellon SA and Pluxee will be similar to that of Sodexo.

BNP Paribas, Citigroup, J.P. Morgan and Société Générale are acting as Lead Equity Capital Market Advisors to Sodexo and Pluxee, and Goldman Sachs and Natixis are acting as Other Equity Capital Market Advisors, in the contemplated listing of Pluxee.

The Group has signed 2 new banking facilities for Pluxee to ensure it has a solid and flexible financing structure in place post the listing. These comprise a €650m 5-year Revolving Credit Facility and a €1.5bn 12-month Bridge Facility. The RCF facility will provide liquidity headroom for Pluxee. The bridge facility will be used to repay existing intercompany debt, and is intended to be refinanced by a bond market issuance in due course and subject to market conditions. BNP Paribas and Société Générale are acting as Coordinators, Mandated Lead Arrangers and Bookrunners, and each of Banco Santander, S.A., Citibank, N.A., London Branch, J.P. Morgan SE, Crédit Industriel et Commercial and ING Bank N.V., French Branch are acting as Mandated Lead Arrangers.

Conference call

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its Fiscal 2023 results.

Those who wish to connect:

- from the UK / International, please dial: +44 (0) 121 281 8004

- from France, please dial: +33 (0) 1 70 91 87 04

- from the USA, please dial: +1 718 705 8796

Access Code: 07 26 13

A live audio webcast is also available on www.sodexo.com.

(1) For the purposes of clarity, Group includes Pluxee before classification as discontinued operation.

(2) Before classification as discontinued operation and reported as part of the Sodexo group